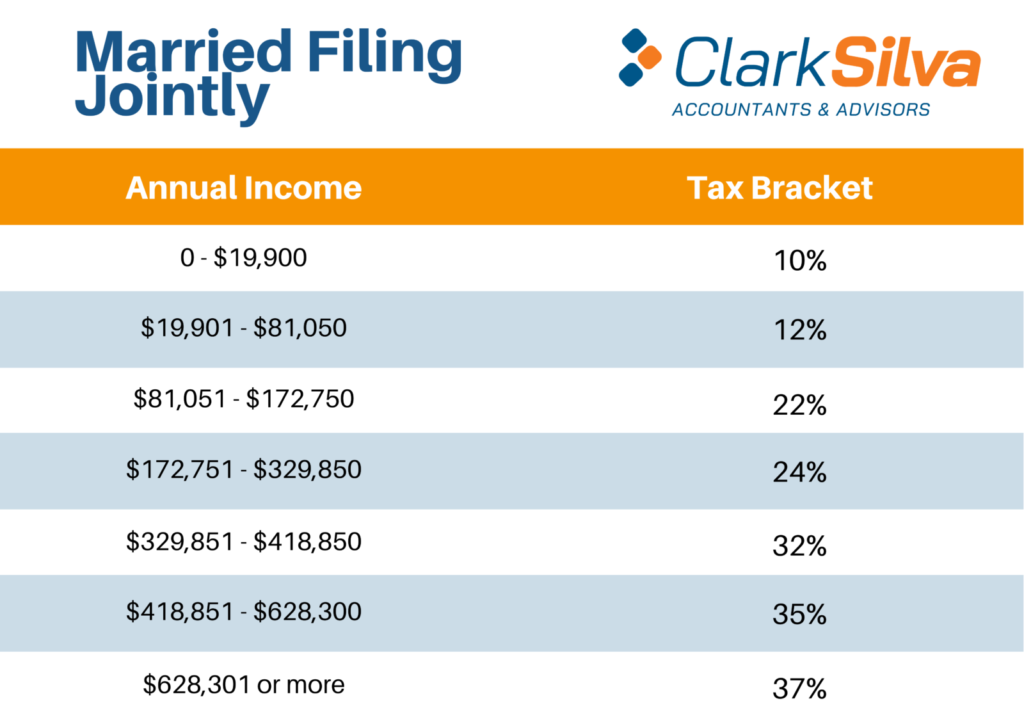

Federal Income Tax Rate For Married Filing Jointly 2024. Taxable income(single) taxable income(married filing jointly) 10%: You pay tax as a percentage of your income in layers called tax brackets.

For the 2023 tax year (for forms you file in 2024), the standard deduction is $13,850 for single filers and married couples filing separately, $27,700 for married. Tax rate single married filing jointly married filing separately head of household;

Taxable Income(Single) Taxable Income(Married Filing Jointly) 10%:

However, in 2024 the same couple with the.

For The Tax Year 2024, The Top Tax Rate Is 37% For Individual Single Taxpayers With Incomes Greater Than $609,350 ($731,200 For Married Couples Filing Jointly).

Single filers and married couples filing jointly;

8 Rows Credits, Deductions And Income Reported On Other Forms Or Schedules.

Images References :

Source: www.wiztax.com

Source: www.wiztax.com

2023 IRS Inflation Adjustments Tax Brackets, Standard Deduction, EITC, As your income goes up, the tax rate on the next layer of income is higher. The federal income tax has seven tax rates in 2024:

Source: neswblogs.com

Source: neswblogs.com

Tax Filing 2022 Usa Latest News Update, The federal income tax has seven tax rates in 2024: And is based on the tax brackets of.

Source: www.nerdwallet.com

Source: www.nerdwallet.com

20232024 Tax Brackets and Federal Tax Rates NerdWallet, For example, in 2019, a married couple filing jointly with a household income of $600,000 would have been taxed at a top tax rate of 37%. Taxpayers whose net investment income exceeds the irs limit ($200,000 for an individual taxpayer, $250,000 married filing jointly, or $125,000 married filing.

Source: clementiawcharis.pages.dev

Source: clementiawcharis.pages.dev

2024 Tax Brackets Married Filing Separately 2024 Manda Jennie, It is mainly intended for residents of the u.s. For the tax year 2024, the top tax rate is 37% for individual single taxpayers with incomes greater than $609,350 ($731,200 for married couples filing jointly).

Source: federalwithholdingtables.net

Source: federalwithholdingtables.net

2021 married filing jointly tax table Federal Withholding Tables 2021, For the tax year 2024, the top tax rate is 37% for individual single taxpayers with incomes greater than $609,350 ($731,200 for married couples filing jointly). As we previously mentioned, your taxable income and filing status dictate the tax rate and bracket that apply to you, determining the amount you owe on various.

Source: www.taxpolicycenter.org

Source: www.taxpolicycenter.org

How Federal Tax Rates Work Full Report Tax Policy Center, And is based on the tax brackets of. Total federal income tax due:

:max_bytes(150000):strip_icc()/ScreenShot2022-01-31at1.13.55PM-a2b3cbcfea7346ccb4ca3b2564f1692f.png) Source: www.investopedia.com

Source: www.investopedia.com

W4 Form How to Fill It Out in 2022, Taxable income(single) taxable income(married filing jointly) 10%: Federal income tax total from all rates:

Source: federal-withholding-tables.net

Source: federal-withholding-tables.net

Federal Withholding Tax Filing Jointly Federal Withholding Tables 2021, You pay tax as a percentage of your income in layers called tax brackets. Tax rate taxable income (single) taxable income (married filing jointly) 10%:

Source: www.financialsamurai.com

Source: www.financialsamurai.com

2022 Tax Brackets And The New Ideal, Tax rate single filers married couples filing jointly married couples filing separately head of household; The income tax calculator estimates the refund or potential owed amount on a federal tax return.

Source: williamskeepers.com

Source: williamskeepers.com

Tax Rates and Brackets WilliamsKeepers LLC, For example, in 2019, a married couple filing jointly with a household income of $600,000 would have been taxed at a top tax rate of 37%. Taxable income(single) taxable income(married filing jointly) 10%:

Total Federal Income Tax Due:

Single filers and married couples filing jointly;

As We Previously Mentioned, Your Taxable Income And Filing Status Dictate The Tax Rate And Bracket That Apply To You, Determining The Amount You Owe On Various.

The income tax calculator estimates the refund or potential owed amount on a federal tax return.